1098-T

The general information listed below should not be considered as tax or legal advice; please contact the Internal Revenue Service (IRS) or a qualified tax professional for tax preparation advice. The University cannot provide assistance regarding your eligibility or the calculation of the credits.

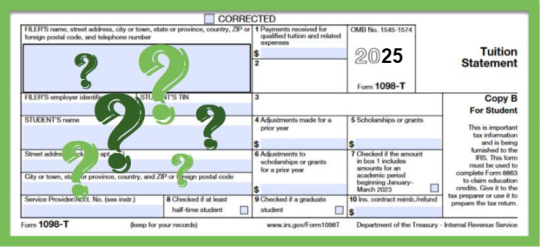

The 1098-T form (1098-T) is used by eligible educational institutions to report information about their students to the IRS as required by the Taxpayer Relief Act of 1997. Eligible educational institutions are required to submit information pertaining to qualified tuition and related expenses, as well as scholarships and/or grants, taxable or not. This form is informational only. It serves to alert students that they may be eligible for federal income tax education credits. It should not be considered as tax opinion or advice.

While it is a good starting point, the 1098-T, as designed and regulated by the IRS, may not contain all the information needed to claim a tax credit. There is no IRS requirement that you must claim a tuition and fees deduction or an education credit. Claiming education tax benefits is a voluntary decision for those who may qualify.

If you paid Qualified Tuition and Related Expenses (QTREs), excluding QTREs that were fully paid by scholarships or grants, then you should expect to receive your 1098-T no later than January 31st. If you consent to receiving your 1098-T electronically, you will be able to view and print your 1098-T by logging into your MySSU, clicking on “Student Self Service” (upper left corner), clicking on the “Finances” tile, then clicking on “View 1098-T”. If you do not consent to receive your 1098-T electronically, your 1098-T will be mailed by January 31st to your mailing address on record.

IMPORTANT NOTE TO ENSURE PAYMENTS ARE INCLUDED ON THE 2025 1098-T - To account for the school closure during the winter holiday break, in order for any payments on qualified tuition and related expenses to be posted to your student account for the 2025 calendar year and thus be reflected in Box 1 of the 2025 1098-T, your payment must be received by the following dates:

- Mailed Payments: Payment must be received by the University no later than December 11, 2025.

- In-Person Payments at the Seawolf Service Center: Payment must be received, in cash or check, at the Seawolf Service Center no later than December 12, 2025. Accepted payment methods are: check, cashier's check, money orders, WolfBucks, and cash.

- Online Payments: Payment must be made online by December 31, 2025.

Payments received for qualified tuition and related expenses after the deadlines noted above will be processed in the 2026 calendar year and will be reflected on the next tax year’s 1098-T statement.

In January of each year, Sonoma State University prepares a 1098-T for all students whose payments of qualified tuition and related expenses (QTRE's) were greater than scholarships or grants received during the previous calendar year. The 1098-T the student receives is the information that was sent to the IRS by Sonoma State University. The 1098-T is informational only and should not be considered as tax opinion or advice. It serves to alert students that they may be eligible for federal income tax education credits such as the American Opportunity Credit and Lifetime Learning Tax Credit.

Receipt of a 1098-T does not indicate eligibility for the tax credit. To see if you qualify for the credit, and for help in calculating the amount of your credit, see IRS publication 970, Tax Benefits for Education.

If Sonoma State University is required to produce a 1098-T for you, the form will be mailed out or made available electronically by January 31st. The fastest way to receive a 1098-T is for students to log into their MySSU account and access the form electronically. To locate the current or past year’s 1098-T in the MySSU account, click on "Student Self Service" (upper left corner), click on the “Finances” tile, then click on “View 1098-T.” The 1098-T form is not viewable on mobile devices therefore the use of a laptop or desktop computer to access and print the 1098-T form is required.

There are several reasons why a 1098-T may not have been required to be generated or why you did not receive one:

Scholarships/grants received were greater than QTRE payments. When scholarships and grants (Box 5) are greater than the payments you made on Qualified Tuition and Related Expenses (QTREs) (Box 1), you are not eligible to take an education credit, thus the IRS does not require the University to furnish a 1098-T (IRS regulation 1.6050S-1).

Note: Student Loans are not considered a scholarship or grant since you are required to pay loans back; student loans that are used to pay QTRE’s will be reported as a payment in Box 1.

- Graduated (or stopped attending) after the Spring Term and you paid the Spring term fees in the calendar year 2024 – If you graduated in the Spring term, the information would be included in the prior year’s 1098-T. In order to determine whether the Spring term was included on a prior year’s 1098-T, review Box 7 on the 1098-T.

- International (foreign) Students - If you are not a U.S. resident for tax purposes, the University is not required to issue a 1098-T.

- No Qualified Tuition and Related Expenses (QTRE's) payments made during the Calendar Year – If you did not pay for any qualified tuition and related expenses during the calendar year, you will not receive a 1098-T.

- Continuing Education (Extended Education) – For programs not resulting in a degree, the University is not required to issue a 1098-T.

- No Active Address in your MySSU Account - An active address on your MySSU student account is required by the university in order to successfully generate a 1098-T. Be sure to check your personal information and have an active address listed.

- Incorrect or Wrong Address - If your 1098-T was sent to an old or incorrect address. In this case, you can update your current mailing address and access an electronic 1098-T copy in your “Student Center” in your MySSU account.

- Attended the CSU International Program - If you were enrolled in the CSU’s international program during the preceding calendar year, you must contact the CSU International Program Fiscal Affairs Division at [email protected] or by phone at (562) 951-4790 to request a 1098-T. This is because you were charged qualified tuition by the CSU International Program and not the University, therefore only they can issue the 1098-T.

The University reports payments made on QTRE during the tax year you made the payment. For example, the Spring 2025 semester registration took place in November and December 2024. In this case, if you paid those charges in calendar year 2024, those payments would be included on the 2024 1098-T.

Students at Sonoma State University have the option to Go Green and consent to receive their 1098-T electronically. If you would like to receive your 1098-T electronically, please grant consent by logging into your MySSU, click on “Student Self Service” (upper left corner), click on the “Finances” tile, click on “View 1098-T” and then click on “Grant Consent.”

Qualified tuition and related expenses included in Box 1 are:

Tuition and fees required for enrollment or attendance at an eligible educational institution (Sonoma State University) such as:

- State University Fee (Tuition Fee)

- Nonresident Tuition Fee

- Student Union Fee

- Associated Students Fee

- Instructionally Related Activity Fees

- Required Course Fees

- Professional Program Fee

- Facilities Fee

- Consolidated Services Fee

Qualified tuition and related expenses not included in Box 1 are:

- Books, supplies and equipment needed for a course of study (Note: The Seawolf Bundle fee is not a required fee; therefore, it is not reported as a qualified tuition and related expense in Box 1 of the 1098-T. You can find the amount you paid for the Seawolf Bundle in your MySSU student account. The University does not track the amounts paid for books and supplies outside the Seawolf Bundle fee, and these amounts are also not reported on the 1098-T. You must keep your own receipts and records for these types of expenses to determine any potential educational tax deductions or credits.)

Ineligible expenses for calculating tax credits/deductions, thus not reported in Box 1 include:

- Room and Board Charges

- Student Health and Wellness Fee (effective Spring 2026)

- Health Services Fee

- Counseling and Psychology Fee

- Continuing Education Fees (unless the course is part of a degree program)

- Late Fees or Fines

- Insurance fees/charges

- Medical expenses

- Transportation expenses

- Student Involvement & Representation Fee (SIRF)

- Other personal, living, or family expenses

See IRS Publication 970 for specific examples of qualified and unqualified tuition and related expenses.

- For actual payments made, please refer to your own financial records, or you may obtain an itemization of your financial activity by logging into your student center in MySSU via the portal, click on “Student Self service” (upper left corner), click on the “Finances” tile, click on “Account Inquiry,” and then click the “Payments” tab. You can then use the date filter to view the payments made on your student account.

All scholarships and grants administered and processed by SSU are reported in Box 5 on the 1098-T. Loans are not reported on the 1098-T.

Determination of eligibility is the responsibility of the taxpayer. The University is required to file a 1098-T with the IRS for each student who paid qualified tuition and related expenses that were not fully paid by scholarships or grants. It is important to note the University cannot provide individual income tax advice. If you have any 1098-T tax-related questions regarding the tax credit, eligibility, or reporting your tax credit on your tax return, please consult with a qualified tax professional or contact the IRS Taxpayer Assistance line at 1-800-829-1040.

You or your parents may be eligible for educational tax credits on your tax return. The Taxpayer Relief Act of 1997 created two educational tax credits for students and families, the American Opportunity Credit and the Lifetime Learning Tax Credit. For a more detailed description, you can read IRS Publication 970 which can be found on the IRS website.

- You can log onto your MySSU

- Click on "Student Self Service" (upper left corner), click on the "Finances" tile, click on "Account Inquiry," and then click the "Activity" tab. You can then use the date filter to view the charges and payments made on your student account.

You should use the information on the 1098-T form in conjunction with your own payment records to complete your individual tax return. If you have questions about how to compute an education tax credit, consult your tax professional or refer to IRS Publication 970. Additionally, each taxpayer and his or her tax advisor must make the final determination of qualifying expenses.

If you have questions specific to the data provided by Sonoma State University on your 1098-T, you can:

- Call: Seawolf Service Center at (707) 664-2308

- Email: [email protected]

- Visit: Seawolf Service Center, Salazar Hall 1000

For information regarding filing your taxes and benefit eligibility, please contact a qualified tax consultant or the IRS at 1-800-829-1040, or go to www.irs.gov.

No, Americorps payments are not reported in Box 5 since these payments are not considered a scholarship or grant. Americorps payments are considered taxable income to you, and you may receive a 1099-MISC from Americorps. Therefore, you may be able to deduct QTRE's paid by Americorps.

No, 529 Education Plan payments are not reported in Box 5 since these payments are not considered a scholarship or grant. 529 Education Plan payments are considered taxable income to you, and you may receive a 1099-MISC from a 529 Education Plan. Therefore, you may be able to deduct QTRE's paid by a 529 Education Plan.

Disclaimer: Sonoma State University does not assist in tax preparation, act as a tax consultant for individuals or entities, provide tax advice, and cannot answer your tax questions. Please consult a tax professional, the IRS, or a financial planner who is proficient with taxation with your tax questions. Each student and/or their parents must determine eligibility for, calculation of, and limitation on the tuition and fees deduction or the education credits (American Opportunity Tax Credit (AOTC) or Lifetime Learning Credit). While the University has made every effort to use the most current and accurate data, tax laws change frequently, and it is possible that some of the information may no longer be accurate. The University disclaims all liability from the mistreatment of information and materials contained in this document. Please keep in mind that no one from Sonoma State University, while in their official role at the University, can act as a tax consultant, give personal, legal, or tax advice, or represent an individual dealing with the Internal Revenue Service (IRS). Thus, any assistance the above information may provide is given as a courtesy to you, and as such, should not be construed in any way as the rendering of legal or tax advice.